Resources

5 Creative Ways to Finance Renewable Energy Projects

- Published: June 11, 2020

- Read Time: 8 Minutes

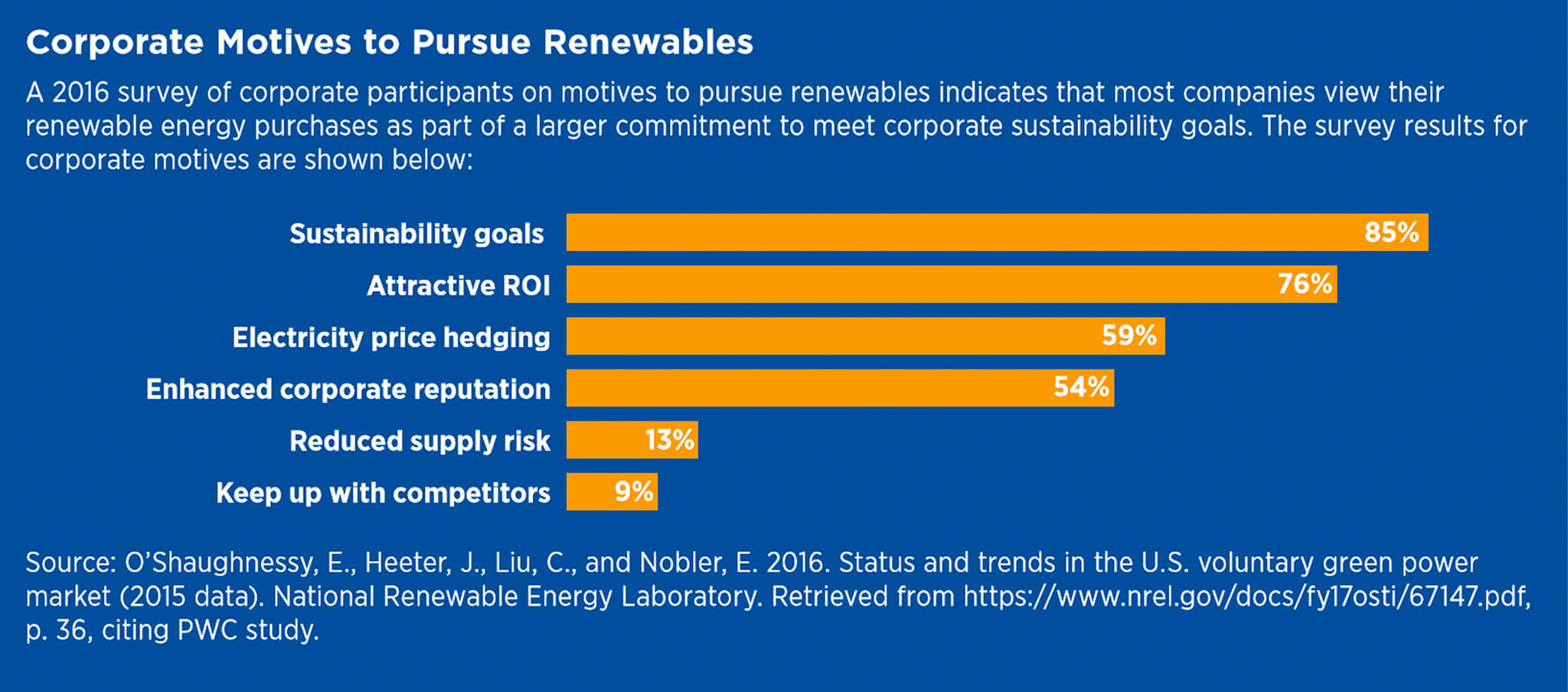

Now more than ever, power reliability is key. Whether in the seasonal weather zones of the Midwest or East Coast, or the fires and earthquakes of the West Coast – the grid grows increasingly unreliable. According to the EPA’s status and trends graph below, more and more large energy users are looking for ways to save on their electricity costs, create redundancy and reliability, and decrease their carbon footprint.

- Source: Guide to Purchasing Green Power, EPA

- Note: Though much has changed since 2016 (especially the decreased cost of renewable energy), corporate motives remain similar.

Enter Renewable Energy & On-Site Generation. These projects can produce enormous economic, operational, and environmental benefits but the question is – how to pay for them?

Before we jump in, we must say that by the time we get to final financing decisions for our customers, we have already developed the project, performed a detailed feasibility of technologies, RFP (if applicable) and some key terms and conditions negotiations. So here we go.

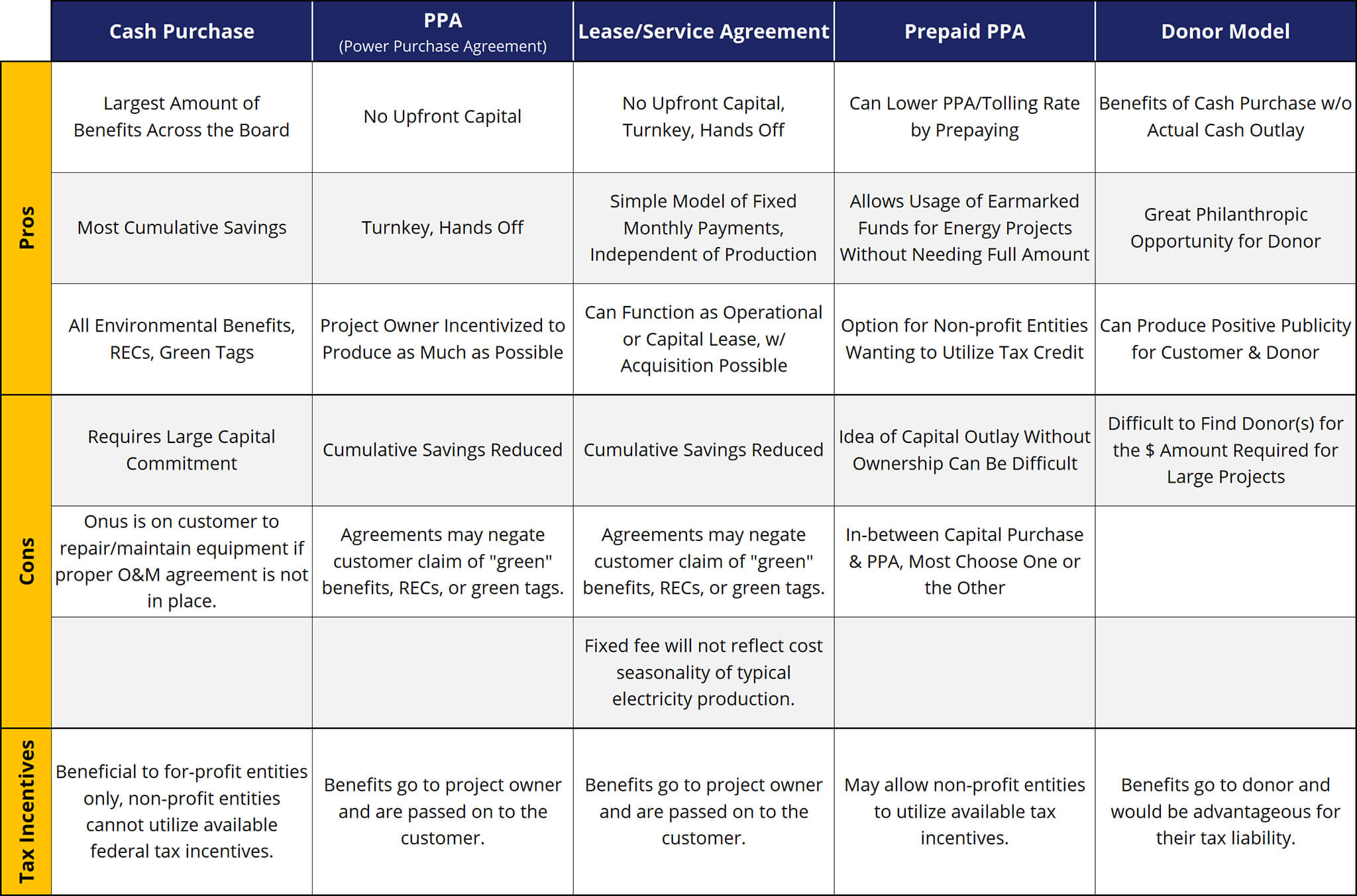

1. Capital Purchase (CAPEX)

The most well-known method of paying for projects is a capital purchase, or cash purchase. It is a straightforward approach sometimes referred to as a CAPEX (capital expenditure). It goes something like this; you buy the project, you own it, and you operate it and reap all the benefits. This is similar to how many of us operate our personal finances, through cash, check, or debit card. This option assumes ongoing operations and maintenance agreements are in place for a vendor to service the technology and maintain performance and keep with their contractual obligations.

Pro: Produces the largest amount of benefits across the board.

Cons: Requires a large amount of capital to be paid upfront. Can put the onus on the customer to repair or maintain equipment if a proper O&M agreement is not in place.

Tax Incentives: Beneficial to for profit entities that can utilize and maximize federal tax incentives. Not beneficial for non-profit entities that cannot utilize federal tax incentives.

2. Power Purchase Agreement (PPA)

A Power Purchase Agreement (PPA) is the second most well-known financing method but is quickly becoming the go to option for many customers. Even residential users will be familiar with a PPA structure as the flurry of signs and ads with “$0 down solar” or “no upfront capital needed” abound. This method allows for a vendor and financier to install a technology/ project on a customer’s premises and keep ownership of the project. The owner/financier would front all install, construction, and equipment costs as well as any ongoing operations and maintenance as they are incentivized to have the system produce as much electricity as possible. The customer pays the project owner only for the electricity that is produced by the system monthly. Unit costs paid by the customer to the system owner are set contractually via a PPA or Tolling Rate. Here is an overly simplistic example: if a customer has an average unit cost of $0.18/kWh for electricity, a renewable or onsite generation technology may provide electricity for $0.14/kWh. This provides savings for the customer of $0.04/kWh. Actual costs for the project owner may only be $0.10/kWh which allows for ongoing revenue for the project owner.

Pros: No upfront capital, hands off, project owner is incentivized to produce as much as possible

Cons: Total cumulative savings are reduced. Some agreements take away legality of claiming “green” power or participating in the Renewable Energy Credit or green tag market.

Tax Incentives: Does not matter if the customer is non-profit or for profit as the project owner will utilize all tax incentives and may pass the benefits on to the customer in a lower PPA/ Tolling rate.

3. Lease or Service Agreement

A lease or service agreement is similar to a PPA. However, instead of your monthly payment depending on your PPA/ Tolling rate and actual electricity produced – the lease or service agreement would be a fixed monthly fee. This method is sometimes used to make it simple for customers to accept a fixed fee without worrying about PPA escalators, changing monthly electricity costs, and view it more as an operational or service cost than a utility expense.

Pros: Very simple to understand and accept an unchanging fixed monthly “service fee”. No upfront capital, hands off, project owner is incentivized to produce as much as possible

Cons: A fixed fee may not reflect the seasonality of electricity performance where winter months are less costly than summer months. Potential cumulative savings are reduced. Some agreements take away legality of claiming “green” power or participating in the Renewable Energy Credit or green tag market.

Tax Incentives: Does not matter if the customer is non-profit or for profit as the project owner will utilize all tax incentives and may pass the benefits on to the customer in a lower PPA/ Tolling rate.

4. Pre-Paid PPA

A prepaid PPA combines some benefits from a capital purchase but utilizes a similar structure to a traditional PPA. The idea of prepaying a PPA is similar to a buying points to lower your mortgage rate. If a customer has cash earmarked but not enough to pay for the entire project, they may prepay some of the PPA agreement and receive a lower PPA/Tolling Rate in return. Another benefit is that non-profit entities may be able to now utilize the federal tax incentive benefits. In this scenario a customer can essentially pay for the project (pre-pay the full PPA) the same way they would a capital purchase but the vendor/ financier would utilize the tax benefits on behalf of the non-profit customer and pass those on to the customer. As you can imagine, this requires a bit of contractual expertise as making sure ownership passes and early buy out clauses are set up properly, but it is feasible.

Pros: Can produce a lower PPA rate by prepaying. A benefit for non-profit entities looking to utilize federal tax incentives via a cash purchase/ prepay.

Cons: This can be a happy medium between a capital purchase and traditional PPA, but most customers choose either one or the other, the idea of shelling out a chunk of capital but still not owning the project in some cases can be a tough sell.

Tax Incentives: May allow non-profit entities to utilize tax incentives.

5. Donor Model

This method is the hardest to come by but most beneficial for the obvious reason that the project is donated to the customer. This unique situation arises when a donor (let’s say for a Children’s Hospital or non-profit organization with a fundraising arm) has a donor that wants to contribute a large amount of capital to a public project. The donor may give millions of dollars by becoming owner of the renewable energy or on-site generation system that is installed on the customer’s premises. The donor would own the system on paper for 5 to 7 years depending on how the tax incentives and depreciation are structured and after this period, the donor would turn the system over to the customer. Additionally, there can be contractual arrangements made between the donor and customer wherein an internal PPA agreement can be executed that allows the donor to make a minimal amount of money with a small PPA rate for those select number of years. While more complex, it is also possible to get a group of donors to come together and arrange the same type of model.

Pros: No capital outlay. Great philanthropic opportunity for a donor.

Cons: Tough to find donor(s) in the amounts required for a large renewable energy project.

Tax Incentives: Would go to the donor and can be advantageous for donor’s tax liability.

Tax Incentives & Incentive Programs

It is important to remember that many states and utilities offer incentives, rebates, and programs to encourage the deployment of renewable energy, on site generation, and battery storage systems. Next, the Tax Incentive benefits noted reference the Federal Incentive Tax Credit (FITC). This is a tax credit given as a percentage of the total project cost to encourage the installation of on-site generation technologies and renewable energy. This is only available to for profit entities.

Which One Is Best?

There are many creative ways to finance projects and while this list is not exhaustive of all solutions, it is comprehensive and comprises all methods we have worked with for renewable energy and on-site generation projects. So, the question arises – which is the best method? Well, sorry to say there is no straight answer because as we find in working with customers, everybody has different goals and resources. If you want to maximize savings then a capital purchase is best, assuming the capital is available. Perhaps your cash position is not as strong as you want and so are looking for a project that will provide immediate savings, then a PPA is for you. That being said, our ideal scenario is full ownership and benefits of the project with a capital purchase. However, each method carries its own set of pros and cons, so it is important to have a knowledgeable and objective party on your side to help evaluate all the technical, operational, economic, and environmental options. Cheers to taking control of your energy portfolio!

About Carlos Lopez II, CEP, REP, BEP, CSDP

As Managing Principal, Carlos is responsible for strategic development, oversight, and execution of Ecom-Energy’s expansive products and services. Likewise, he maintains clientele relations with regular and comprehensive analyses of market trends and opportunities while aiding in the company’s energy management strategies.